Complaint Review: Ally bank - Horsham Pennsylvania

- Ally bank P.O. Box 951 Horsham, PA 1 Horsham, Pennsylvania USA

- Phone: 8872472559

- Web: www.ally.com

- Category: Banks

Ally bank Deceitful Fee Charging Horsham Pennsylvania

*Consumer Comment: Account Management

*Consumer Comment: A Better Idea

*Consumer Comment: Right. All THEIR Fault!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

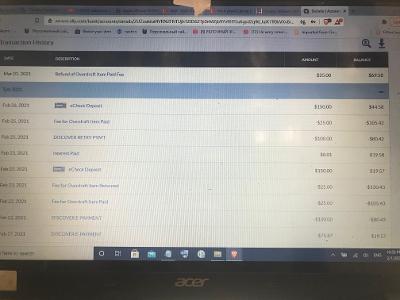

Ally use to be good. But sadly this is no longer the case. They have raised fees. Put $10 cap on ATM fee reimbursement. They also are scandalous in there system. Debits are applied before credits which means if you have low balance and have a bill on auto pay and you put money in your account the same day, the bill is paid first and you are charged an overdraft fee which is now $25 a hit. Also if you have an both an Ally savings and Checking account with overdraft protection with less than $100 in savings, But enough money to cover overdraft, they will still overdraft your account, and hit you with their fee. You get 1 overdraft fee reimbursement for the Lifetime of the account. Not monthly or annually LIFETIME OF THE ACCOUNT. Worst of all is there TERRIBLE Customer service which btw is only 24/7 phone or email now. All the things that made Ally great are now gone. Best to look else where for your online banking needs.

This report was posted on Ripoff Report on 10/17/2015 06:49 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ally-bank/horsham-pennsylvania-19044/ally-bank-deceitful-fee-charging-horsham-pennsylvania-1261988. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Account Management

AUTHOR: Robert - (USA)

SUBMITTED: Sunday, October 18, 2015

There are two words that will help you out..ACCOUNT MANAGEMENT.

You see, this is YOUR money and YOUR responsibility. In the next couple of paragraphs I will tell you how to avoid every one of your issues. Oh and this will also apply for the next bank you go to as well.

First on the ATM withdraw. Just about every major chain store allows cash back on a purchase when using your debit card, without a fee. Now, most limit it to $40 at a time but if you find yourself going to the ATM for small withdraws this can help quite a bit to combine your "ATM Runs" with purchases. If you find you need more than the $40, then think ahead. If you for example are withdrawing $100 every few days, go once and withdraw $200..again THINK AHEAD.

Then we get to the ones that are 100% YOUR fault for any fees. You know you have an Auto-Pay coming up and you know that they post debits before credits. So you have a choice. To not spend money from your account knowing you have an auto-pay coming up. Oh you say that the money you had to spend was an "emergency" and you HAD to spend it. Okay...then let's look at your savings.

You say you had enough money to cover the overdraft. You say you know you will overdraft. So the answer is simple. Instead of waiting on the bank to "cover" the overdraft, you transfer the money from savings to checking BEFORE. Then as soon as your paycheck clears, you put the money you transfered back into savings.

Oh that doesn't work for you. Okay, then why not work on building your savings up to above the $100 minimum? Even a minimum amount will add up fairly quickly. For example if you were able to put $25 per paycheck into your savings within 4 checks you will be above the $100 minimum. How many times do you eat out? How many runs do you make to your favorite coffee shop? How about those movies? I bet you could find that $25 somehwere. Now, you say you live paycheck to paycheck and can't even afford to do that. Well if $25 is truly what is the difference between you being able to survive and becoming destitute and on the street, you have bigger issues that you need to deal with(and I am not talking about with the bank). Oh and the plus side to making it a point to save, if you truly do that over time if a true emergency comes up it will be quite nice to have that little buffer.

But then there is of course, why do you even have the savings if you have less than $100 in it? Just close it out and put all of your money into your checking so you don't have to worry about any overdraft protection.

See..in just a couple of paragraphs I took care of all of your fees....

Now yes, this actually requires YOU to take responsibility for your account and not sit on your butt with your thumb up your nose wondering why the big bad bank is not just doing all of this for you. Where I am sure you are saying things like "I don't have the time". Well guess what all of what I am talking about takes minutes..that's right..minutes. For example in the time it took you to read this post you could have logged onto your account and initiate the transfer.

But if you still truly feel that way what it looks like you are really looking for is someone to basically just be your personal assistant. Well your in luck, there are many accountants who can do exactly this. The even better news is that they will only charge you a couple hundred bucks per month for their services.

#2 Consumer Comment

A Better Idea

AUTHOR: coast - (USA)

SUBMITTED: Saturday, October 17, 2015

“Best to look else where for your online banking needs.”

You could do that or simply not authorize debits against unavailable funds.

#1 Consumer Comment

Right. All THEIR Fault!

AUTHOR: Jim - (USA)

SUBMITTED: Saturday, October 17, 2015

What you're saying is you expect the funds to be available the exact second you deposit them. I'll bet you've never read the Funds Availability policy which is one of the terms YOU agreed to when you opened up the account. You also make it very clear you don't even bother keeping written records of each and every ATM card usage or checks written. You use the card without having any knowledge of the balance in your account because what you do is just check the on line balance which even they tell you IS NOT accurrate! Your concern about overdraft fees says that very obviously. So why not quit overdrafting and generating more fees for them???

BOTTOM LINE: The problems YOU are having with this bank are SELF GENERATED because you don't keep written records and you have zero knowledge of the F/A policy. You have very valid complaints however, and those complaints should be addressed directly to you and your "management" of your own account!

Let me save you some trouble...don't bother writing back, "You must work for them!", because I don't!

Advertisers above have met our

strict standards for business conduct.