Complaint Review: ALLY BANK - Internet

- ALLY BANK Internet USA

- Phone:

- Web: www.ally.com

- Category: Banks

ALLY BANK Bank policies detremental to account holder Internet

*Consumer Comment: Still very short sided and unrealistic

*Author of original report: Rebuttal to Robert

*Consumer Comment: Yep, they are living large...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

ALLY ONLINE BANKING ISSUES

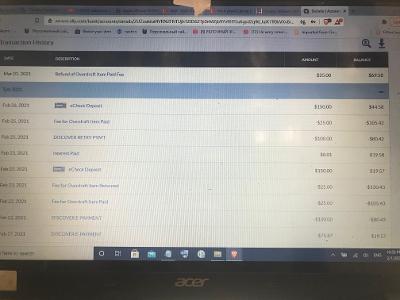

I recently discovered–the hard way–several issues with my ALLY bank account. Like most full time RV-ers I travel a great deal, about nine months out of the year and all over the US. Like most I have an online bank account that I use in two primary ways.

1) I pay bills through the electronic bill pay service.

2) I use my debit card extensively.

ALLY bank has now done two things.

1) They debit my account for the electronic payment on the day they send out the payment. However, it may be one to two weeks later before the payment actually clears. During that time ALLY earns interest on the funds, but I do not. Consider that if I had issued a paper check I would have earned interest until the check cleared.

2) ALLY has set their security system to block transactions on my debit card whenever I use it away from my home base unless I have provided them with an itinerary including where and how long I will be someplace other than my home base.

Put simply ALLY has reduced the usefulness and increased the cost of doing business through their bank.

This report was posted on Ripoff Report on 02/20/2015 01:51 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ally-bank/internet/ally-bank-bank-policies-detremental-to-account-holder-internet-1210551. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Still very short sided and unrealistic

AUTHOR: Robert - ()

SUBMITTED: Sunday, February 22, 2015

Let us look at your claim that they did this to 500,000 customers. Okay so where do you get this number? But even so let us take your number as fact and they "made" 6,000,000 in Interest. In 2014 their net income was 1.2 Billion dollars, so this 6 Million would be about 0.5% of their total income. So yes, to me and you 6 Million is quite a chunk of change, to a bank like Ally it would be about equivelent to you seeing a penny on the other side of a 4 lane street.

One other point I did not make. This is also how just about every other bank handles their On-Line bill pay system. The money is deducted the date you have them send the payment. I don't know why yours is taking 2 weeks to "post", as even if they cut a "check" and mailed it, it should be no more than days. So I would look more at the merchants you are sending it to rather than ally.

As for these "chipped" cards. Guess what...they are ON THEIR WAY, but not just with Ally with ALL banks. The reason that they are not wide spread now is not because of Ally alone. Only a couple of banks have STARTED to introduce the chipped cards, more will come "on line" over the next few months. The main reason though that there is not wide spread use currently isn't because of the banks. It is at the other end of the sales process...the Merchants.

As there are currently only a miniscule number of POS systems that can currently even take advantage of these cards. However, as of October of this year the Merchants are now going to be held more accountable for fradulent card use, so this is what is going to bring these systems into place.

#2 Author of original report

Rebuttal to Robert

AUTHOR: Albert - ()

SUBMITTED: Saturday, February 21, 2015

Robert performs a correct set of calculations but misses two critical points.

1) The traditional method was for a customer's account to debited when the payment instrument cleared. This is not what is happening here where ALLY is debiting the account in anticipation of clearing.

2) While the calculation is approximately correct it missing the point. For a bank with say 500,000 customers the bank is making $6,000,000 while depriving its customers of this amount. Of course the bank could charge a fee for the service but then that would be out in the open and subject to competitive pressures and complaints.

With regard to security, the demand for advance notice of where one will be is in lieu of doing what Europrean and Canadian banks have been doing for years--issuing cards with security chips that have been proven to be highly effective in limiting fradulent use. Of course that would cost the banks some extra money and when the burden can be placed on the customer at a lower cost, why should they do it? I should also note that for five years this was not an issue with ALLY in the US and when I lived in Mexico, it is only a requirement that popped up this week without warning.

#1 Consumer Comment

Yep, they are living large...

AUTHOR: Robert - ()

SUBMITTED: Friday, February 20, 2015

So they are just feasting off of the interest they are making off of you by debiting your account when they send the payment.

Yea, well let's take a look at that. According to the Ally website, figuring you have over $15,000 on account you earn the amazing interest rate of 0.6%. That works out to a monthly rate of about 0.05%. Now, let's just go to the extream and say that they have these funds "floating" around for a month. You also didn't say how much is this amount, but let's figure you have about $2000 in funds that this happens to. So let us calculate the interest on that $2000 at 0.05%. That comes out to a single brand new crisp $1 bill. That's right...ONE DOLLAR.

As for your debit card. Yes that is anoying but it is also a security feature. After all if by chance your card was ever copromised and attempted to be used in Florida when you were in Oregon, you would be extreamly grateful.

Advertisers above have met our

strict standards for business conduct.