Complaint Review: First Convenience Bank - Internet

- First Convenience Bank Internet United States of America

- Phone:

- Web: http://www.1stnb.com/en/

- Category: Banks

First Convenience Bank First National Bank Deceptive internet banking practices Internet

*Author of original report: Common sense. Yes.

*Consumer Comment: Use Common Sense? Use Your Ledger?

*Consumer Comment: Common sense, anyone?

*Consumer Comment: Register?! Seriously!

*Author of original report: Heh

*Consumer Comment: Your kidding right?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I've been banking with First Convenience for about two years now, and today I have finally suffered the last indignity I will tolerate from them.

This report was posted on Ripoff Report on 05/10/2010 07:11 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-convenience-bank/internet/first-convenience-bank-first-national-bank-deceptive-internet-banking-practices-internet-601798. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#6 Author of original report

Common sense. Yes.

AUTHOR: BobNietzsche - (USA)

SUBMITTED: Friday, October 14, 2011

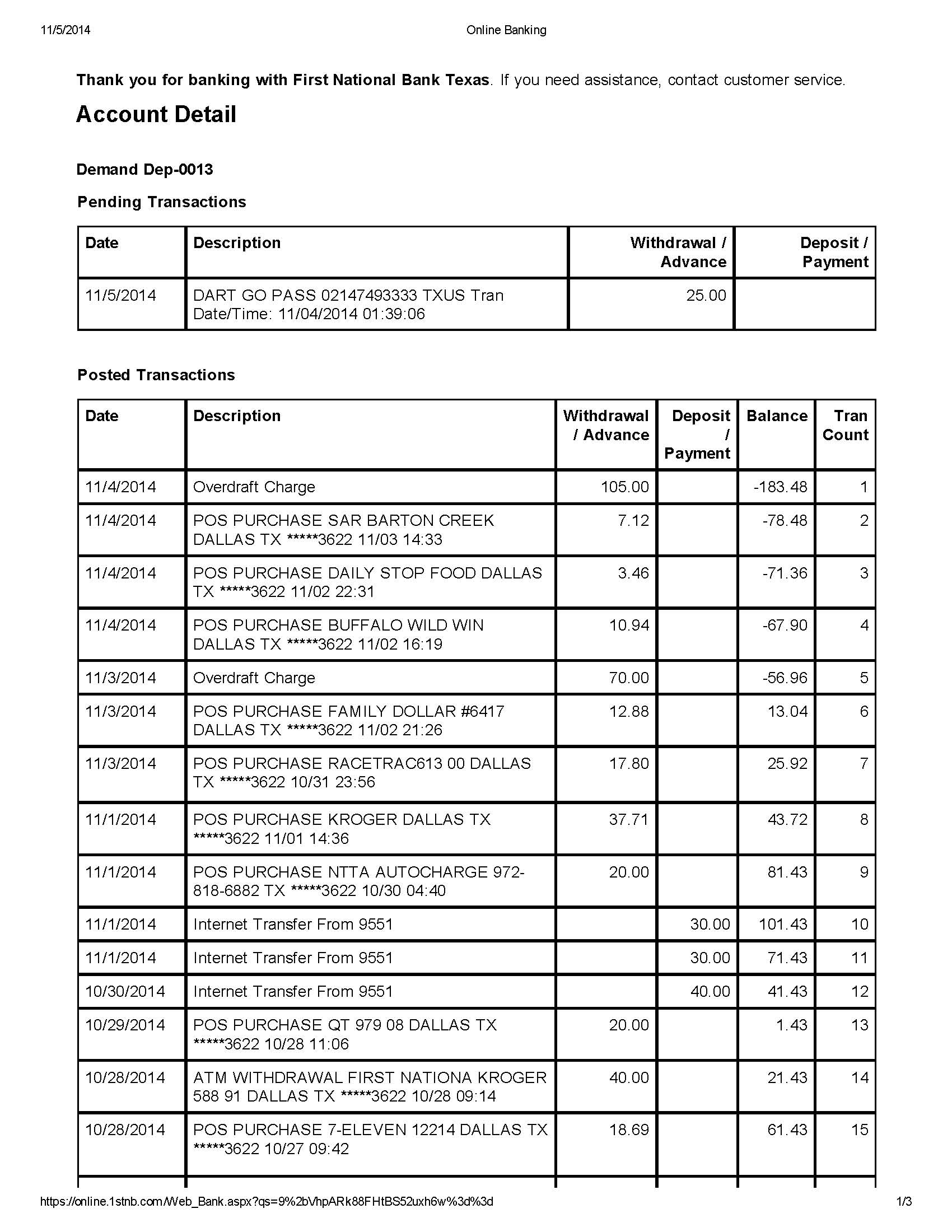

Common sense is a great thing. In this case, common sense dictates that my account should have reflected somewhat less than a positive three hundred dollar amount on the very same day that I received in the mail a letter telling me I was in the red.

In other words, my account was incorrectly tallied, and not just by a little. All the debits, pending or otherwise, were already registered and deducted from the total amount. Then the NSF fairy saw that I'd received my letter, and did what she does best.

Kudos to this banking institution for such exquisite timing. It's almost..intentional.

FYI, to all the naysayers, I have since taken my business to a simple pre-paid debit card that accepts direct deposit, and have yet to come even close to zero ever since.

Neither my spending habits nor my accounting have changed. Only my bank.

#5 Consumer Comment

Use Common Sense? Use Your Ledger?

AUTHOR: iamhip - (United States of America)

SUBMITTED: Friday, October 14, 2011

Perhaps those who have such ideas and suggestions should look deeper into what is gong on at this institution. I had to laugh at the didactic tone of the scolding except for myself being charged $497.00 in overdraft fees. Now one is my fault. A check I wrote for $3.73 eight months ago showed up the day before my direct deposit. I had a $3.61 available balance. First the check was listed as pending and an overdraft fee was charged. The next day the check went through and I was charged another $35.00. I was also charged $2.50 a day for two days for having a negative balance. I should of received an email on this but didn't. Nearly $ 75.00 in charges for that little oversight. I made an error somewhere for being a few cents low. I keep excel ledgers and bank like I have for sixty years.

Next I bought a new iphone and it was defective. I called Apple and they agreed it was a manufacturing problem and they would promptly replace it. I had planned to make the 4o mile round trip to an Apple store. As I bought this phone directly from Apple they said they would send one next day delivery. Fine but I wanted to be sure it worked and was going to a store. They sent one anyway and put a $590.00 pending charge against my checking account. I discovered three days later that I was $ 700.00 over drawn. Apple contacted the bank and told them that it was all a mistake. They did this by fax and by phone. I cannot get the overdraft fees removed as the people at Apple said they should be refunded to me but they were not authorized to pay the $497.00 in fees.

This is predatory banking. Of course they offered the ever-present $700.00 getting even loan.

I banked with Washington Mutual for years and was never double debited for an overdraft. They would ask questions and find solutions and valued me as a customer. I had two or three overdrafts in 15 years which is not good but not bad either. They forgave all three. That is not the banking environment today. 1st Convience Bank does not list your available balance on your ledger. It lists a balance which does not reflect the actual amount you can spend as they leave so many debits as pending for as long as three days. I can see how someone could easily be confused by this and incur great debt.

#4 Consumer Comment

Common sense, anyone?

AUTHOR: center of attention - (USA)

SUBMITTED: Wednesday, October 12, 2011

If your balance was $300 on Saturday, and you got a negative balance letter that same day, wouldn't common sense tell you that you overdrafted before then? Duh.

#3 Consumer Comment

Register?! Seriously!

AUTHOR: ClaraG - (United States of America)

SUBMITTED: Saturday, May 21, 2011

If you use a bank like Bank of America or Chase, you do not need a register, because they are completely accurate at keeping track of your charges, unless you use checks... but who uses those anymore when you can send the check from your bank online and have the total immediately deducted? Oh yah... people that use registers probably.

The point is, why bank somewhere that treats you like this when you can find a bank who is not still stuck in the stone-age?! I'm shocked that they offered you a LOAN to cover the over-draft charges! They've gotten even lower than they were when I banked there, and I didn't even think that was possible. I got a letter about a class action lawsuit against them, and I hope that they go down. It's not worth it for me to get the $90 that I lost to them (we caught it 15 minutes after making the offending 5.00 transaction, and were at the bank the next morning since they didn't have ATMS that accept cash and credit it immediately)

People like you could really benefit from it though, and I hope that it brings these sickos down. And as far as the self-righteous register guy.... go troll somewhere else.

#2 Author of original report

Heh

AUTHOR: BobNietzsche - (USA)

SUBMITTED: Tuesday, May 11, 2010

It's a simple concept. The bank has an online service that allows you to do certain things, such as check your balance. I checked my balance.

#1 Consumer Comment

Your kidding right?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, May 10, 2010

I'm just going to have to accept a hit on my credit and move to another bank.One which is capable of accurately tracking what I have in my account.

No..Unfortunatly I don't think you are. You are one of those people who expect the bank to manage their money thinking you don't have to take any responsibility over it. I guess you fall under the old saying "I am not broke...I still have checks left".

Well the good news for you is that enough people with your attitude complained and the banks are changing their polices. With some banks they will now block this "overdraft coverage" and if you attempt to make a purchase on your debit card with a negative balance it will be declined. Over the next few months this will be an option with every bank. Now, this does not apply to checks or ACH transactions, and it can't account for things such as if the merchant was "off line" at the time you attempted the purchase. So, if you think this is your "get out of jail" card to continue to not take responsibility over your account. You will have a rude awaking. Because no matter what policies are put into place, a lack of responsibility on your part is a sure way to still get hit with overdraft fees.

So listen closely I am going to give you a secret that banks don't want you to know. So what ever you do please do not repeat this, especially at a bank or they might have you arrested for having this "inside" information. I am totally serious if this actually got out who knows where the banks would be. Ready..okay there is something called a "register". It is this magic little book where you actually write down all of your transactions as you make them, and putting in your deposits when they become available. This way you have a running total of your balance. When you start keeping a register a magical thing happens. As long as you don't spend more than you have available in your account you can't overdraft and get hit with overdraft fees. Again..under no circumstance should you repeat this because if you did all the "evil" banks would do is deny the existance of a register and they would have you thrown in the nearest jail for promoting such a thing.

In the mean time if you do switch banks and want to leave this one holding the bag with the negative balance. You better switch fast, as once you are in ChexSystems you will not be able to open up another account at any other major bank for several years. Of course you then also need to hope that the new bank you go to does not periodically review ChexSystems and close your account after you open it.

Advertisers above have met our

strict standards for business conduct.