Complaint Review: First Convenience Bank - Internet

- First Convenience Bank @ Participating Walmarts Internet United States of America

- Phone: 1(800) 677-9801

- Web: https://online.1stnb.com/

- Category: Banks

First Convenience Bank First National Bank of Texas Bank will juggle your transactions to maximize their overdraft fee. Internet

*Consumer Comment: Overdraft Issue

*Consumer Comment: This bank DOES juggle the transaction

*Consumer Comment: Yes,,banks DO juggle transactions....

*General Comment: Bank's do NOT juggle transactions.

*Consumer Comment: FCB OF TEXAS " YOUR AVAILABLE BALANCE"

*Consumer Suggestion: Just keep an accurate register! Problem solved!

*Consumer Comment: Action

*Consumer Comment: Ronny G still doesn't get it

*Consumer Comment: FALSE information ONCE AGAIN left by Steve..

*Consumer Suggestion: All banks will do it exactly the same way. No rip off

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

This bank calls itself First Convenience Bank. The only thing they conveniently do is juggle your transactions to maximize their overdraft charge potential. I know being fiscally responsible is "our" job but living paycheck to paycheck is a struggle to say the least. Every once in awhile, we make mistakes. My wife will go grocery shopping a go a little over budget. If our account is close, this would normally incur you one overdraft charge.

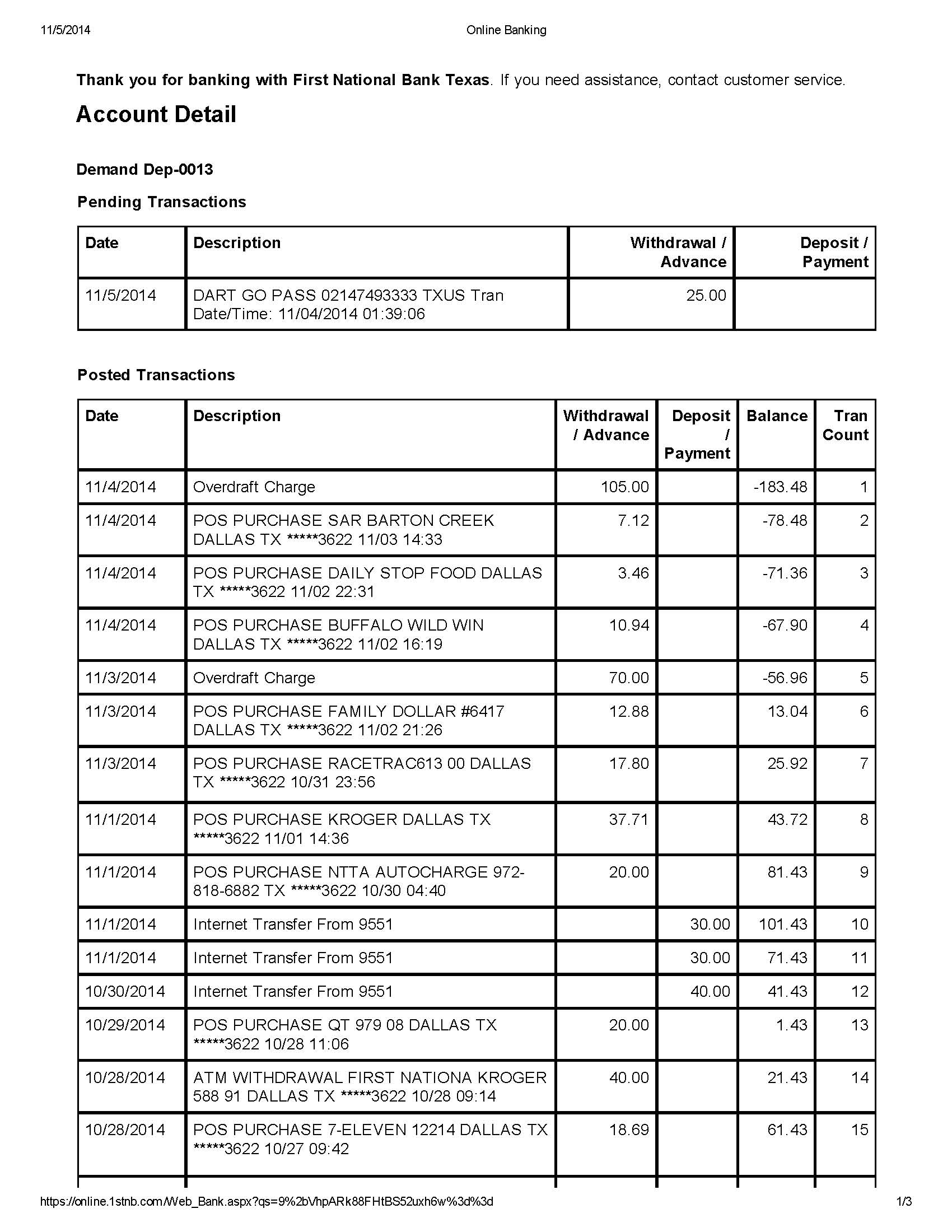

I have monitored my account closely, making daily screenshots and printouts of my deposit and POS charges. With this bank, I have seen posted POS sales sit for days on end without making it to the post column. According to the bank, my "available" balance is still good up until the time when it notices one charge that will cause you to go over your balance. It is at this time that they will bring your one latest charge (most recent) and "post" it which will overdraw your "available" balance causing a single overdraft fee. This fee then puts your account way in the red and ALL OF A SUDDEN, all the "pending" transactions that were still pending for days, comes "POSTING" in and they continue to charge overdraft fees for the remaining pending charges!

I have fought with this bank and fought with them and they argue by throwing some charges at you and telling me that what I'm seeing is not the way it happened. BS! I'll pull up my ledger and see that I'm in the black, I'll see an overdraft fee for an item that was paid but still leaves me in the black and they argue the overdraft fee didn't fall there. WHAT?! How can I still be in the black and get an overdraft fee.

DO NOT BANK AT THIS ESTABLISHMENT if you value your dollar.

This bank will be your worst nightmare.

This report was posted on Ripoff Report on 03/15/2011 03:06 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-convenience-bank/internet/first-convenience-bank-first-national-bank-of-texas-bank-will-juggle-your-transactions-to-706385. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#10 Consumer Comment

Overdraft Issue

AUTHOR: Stephinie - (United States of America)

SUBMITTED: Friday, February 22, 2013

I too have First Convenience Bank. I can understand those who have the issues with the overdrafts from this bank. I also see the point of others about maintained better records of spending.

I have had many of the same issues where my debits would pend for several days. Right before they posted, the dates on all the items were changed to the same day and then would be switched so they would post from largest to smallest amount. The bank has told me that they are not in control of when items posts, but after seeing this happen, I disagree.

I keep track of my spending, and how much is left in my account. However, in the past I have gone over. I had too expectations when I did. I would either have enough time to get money in to make up the difference, or my one item would post and I would be charged an overdraft charge because of my own fault. I would not have argued it either.

However, this does not happen most of the time. They bank would do what I mentioned earlier. They would rearrange all the items that had been pending for DAYS and organize them from largest to smallest. Then I would be left with several overdraft charges. Why didn't the last payment pend? Why would one payment from, let's say...Wal-mart, take days to post when my account was positive, but only hours if it meant the bank would get money for posting my transactions.

Yes, now that I know how they work, I keep an even better track. However, that does not make it right for them to do that. It's not fair to charge overdrafts on items that were spent while they were in the positive.

#9 Consumer Comment

This bank DOES juggle the transaction

AUTHOR: Queen B - (United States of America)

SUBMITTED: Wednesday, July 11, 2012

Regardless of the days the transactions were made, if there is an advantage to bounce the account, they will re-arrange the charges. FCB and all affiliated banks are being sued by lawyers in Houston because they ripped off US Soldiers and their families for thousands in fees juggling charges. Think our troops are irresponsible too?

#8 Consumer Comment

Yes,,banks DO juggle transactions....

AUTHOR: Ronny g - (USA)

SUBMITTED: Sunday, March 11, 2012

....And since this post was brought back from the dead..I will explain...or try to. Some will NEVER get it..

First..let me state for the record I do not overdraft nor have I EVER paid an overdraft fee...oh..I have been charged overdraft fees..but NEVER had to pay any.

The banks systems are automated and totally designed with intent and malice to catch any of us making a mistake or being subject to an unauthorized hold. The laws have changed, the policies have changed and there is practically NO WAY on EARTH a bank can charge us for overdraft fees anymore unless we willingly CHOOSE to have overdraft protection..and then overdraft with intent.

If I am wrong someone...ANYONE challenge me..Explain how ANYONE can be subject to overdraft fees now unless they did it with intent or bounced a freaking check/ach payment. Explain?? I am waiting,.

#7 General Comment

Bank's do NOT juggle transactions.

AUTHOR: Barbeast20 - (United States of America)

SUBMITTED: Sunday, March 11, 2012

It seems that it is always someone else's fault when people incur overdraft charges. There is no such thing as a bank "juggling" transactions to set up customers for more overdraft charges. Most banks will post the largest item first, so if you have one large item that puts you into the negative, then all of your smaller transactions will pile up overdraft fees. Don't always jump to the conclusion of "someone" out there to get you or that you are being screwed over by the bank. Also the reason transactions remain pending for days on end is due to the simple fact that the merchant has not fully processed the purchase out yet. Places like gas stations, rental companies, and hotels have the right to preauthorize holds on a customer's account. Banks don't "juggle" transactions to increase revenues. They simply set up a process because most of the customer's are financially illiterate and don't have any problem solving skills or ambitions to actually find the sole reason for incurring fees. Because they know you are lazy and will choose to complain instead of changing your spending patterns.

#6 Consumer Comment

FCB OF TEXAS " YOUR AVAILABLE BALANCE"

AUTHOR: ASHLEYW0525 - (United States of America)

SUBMITTED: Tuesday, December 20, 2011

I SUGGEST TO THE ONES WHO ARE SAYING THAT HE IS INCAPABLE OF KEEPING UP WITH THE BANK ACCOUNT TO OPEN UP AN ACCOUNT WITH FCB OF TEXAS.. I WOULD LOVE TO SEE YOUR POSTS ABOUT HOW THEY STOLE YOUR MONEY A FEW DAYS AFTERWARDS.... I'M ONLY 22 BUT, I LEARNED HOW TO MAINTAIN A BANK ACCOUNT WHEN I WAS 6. I AM ALWAYS REALLY GOOD ABOUT MY BALANCE, AND I ALWAYS CHECK MY BALANCE BEFORE I MAKE A PURCHASE. " YOUR AVAILABLE BALANCE" " PENDING TRANSACTIONS".. SHOULDN'T YOUR PENDING TRANSACTIONS BE DEBITED FROM YOUR BALANCE; GIVING YOU AN UPDATED AVAILABLE BALANCE. THIS HAS HAPPENED TWICE TO ME . THEY LEAVE DEBITS PENDING FOR DAYS - I HAD A DEBIT PENDING FOR A WEEK BEFORE THEY TOOK IT OUT. . ITS NO WONDER WHY THEY HAVE GUIDELINES YOU HAVE TO MEET TO KEEP A FREE CHECKING ACCOUNT ;

100$ DAILY

dIRECT DEPOSIT

OR

**5 DEBIT CARD PURCHASES***

THEY WANT YOU TO ACCUMULATE AS MUCH PURCHASES AS POSSIBLE SO THEY CAN LEAVE THEM PENDING, TELL YOU HAVE MORE THAN WHAT YOU ACTUALLY DO. i AM OVERDRAFT IN MY ACCOUNT NOW. OVER A $2.00 TRANSACTION THAT THEY COULDN'T MANAGE TO POST ON MY ACCOUNT UNTIL DAYS LATER. F***K fcb. AS SOON AS MY BALANCE IS OUT OF THE RED , I AM CLOSING MY BANK ACCOUNT AND GOING BACK TO CHASE.

#5 Consumer Suggestion

Just keep an accurate register! Problem solved!

AUTHOR: Southern Chemical and Equipment LLC - (USA)

SUBMITTED: Saturday, October 08, 2011

Posting order ONLY affects those who juggle transactions and/or do not maintain a checkbook register.This is just plain old common sense, and third grade math. Are you smarter than a 3rd grader??

Obviously not.

If you deduct checkss, debit card transactions, and other fees from your checkbook register immediately when you make the transaction, posting order will not matter, because the money is already gone for your purposes.

Only people who are too lazy or too stupid to maintain a register have problems with posting order, as they are relying on the online banking to keep a register for them.

As you can see, this never works.

Again, just common sense.

And, why is it that whenever anyone posts something that may indicate the bank did nothing wrong, that person is assumed to work for the bank??

Explain that.

#4 Consumer Comment

Action

AUTHOR: bankripoff - (United States of America)

SUBMITTED: Saturday, October 08, 2011

Steve is obviously somehow affiliated with the bank. Don't waste your time arguing with him. I am seeking out others interested in taking action against them. I can be reached at bankripoff@gmail.com

#3 Consumer Comment

Ronny G still doesn't get it

AUTHOR: Steve - (USA)

SUBMITTED: Friday, March 18, 2011

Hey Ronny, I know you are just pissed off because you pay overdraft fees, and I don't.

You don't keep a checkbook register [as previously admitted] and rely on online banking to determine your balance.

The fact of the matter is, that in over 30 years of banking I have never paid an NSF fee, and never will. So, with that said, posting order means absolutely nothing to me.

You people that pay overdraft fees are the same people that keep ALL of my checking accounts FREE!!

I wish overdraft fees woulod go to $500 each so I could earn some higher dividends on my money!

Actually banks should close any account that overdrafts as it is in default. That would wake people up and force them to be responsible.

I still maintain the position that posting order means absolutely nothing if you properly maintain your account and never overdraft.

After all, maintaining a checking account is like 3rd grade math. Can you do 3rd grade math??

Grow up.

#2 Consumer Comment

FALSE information ONCE AGAIN left by Steve..

AUTHOR: Ronny g - (USA)

SUBMITTED: Thursday, March 17, 2011

It is entirely FALSE and INACCURATE for Steve to post such lies. Not "all" banks juggle transaction posting orders for the SOLE intent and purpose of ripping off customers who make honest mistakes. Many of the banks that conducted this unethical tactic are in court, or have already lost in court.

Regardless....each and EVERY bank that has done this..or still does this will have their day in court. Will you get all of it back? No..you will probably not so you do need to be extremely careful not to overdraft..and IF you use a debit card attached to a checking account..make sure you have in writing that you are NOT enrolled into any type of overdraft protection scheme. The only thing these schemes "protect", is that the bank will profit heavily from any mistakes their customers make, and don't think for a minute that the bank does not do everything in it's power to "encourage"e types of mistakes. It is a mega multi BILLION dollar profit center for banks these days and the law can only do so much.

#1 Consumer Suggestion

All banks will do it exactly the same way. No rip off

AUTHOR: Steve - (USA)

SUBMITTED: Tuesday, March 15, 2011

You are obviously just too stupid to have a checking account.

Don't concern yourself with what online banking says.

What does your checkbook register say?

Close your account and pay cash for everything. Problem solved.

Or, use a small credit card for day to day small purchases, and only write 1 check per month to pay that one credit card.

Or, adjust your lifestyle to live within your means.

If you are living paycheck to paycheck, you are living far beyond your means.

Get some professional financial counseling, and/or another job.

Advertisers above have met our

strict standards for business conduct.