Complaint Review: Santander - Select State/Province

- Santander Texas Select State/Province USA

- Phone:

- Web:

- Category: Car Financing

Santander Same thing happening to me texas

*Author of original report: answer to rebuttal

*Consumer Comment: Simple Questions

*Consumer Comment: You don't have to join a lawsuit against them, you can file your own suit

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I have made 76 out of 73 payments to Santander. They took over my lian at the end of 2010 which was fine until I checked my credit and found that the had made my balance as if I had just had it finance with them brand new. I bought my car new in 2007, its now 2014 and credit report and account show I have a balance over $13,000.00. When I talk to Santander they tell me my loan was not generated through them so there is nothing they can do. I threatened to stop paying, I have proof of all payments no late payments and I read online they are repoing customer's cars even though all the payments have been made. They have a lawsuit against them but I do not know who to call to join this suit. I dont want money from them I want my title. They say my loan will be paid off june 2019, 12yrs of car payments this is nuts and I dont see how they are not stopped. I will only buy a car through my credit union. An expensive lesson. Santander cannot produce the original contract, I have it but they dont. Please do not get financed through them. Google the santander bank 8n europe and see the news on how broke they are right now.. Good luck

This report was posted on Ripoff Report on 02/25/2014 10:38 PM and is a permanent record located here: https://www.ripoffreport.com/reports/santander/select-stateprovince/santander-same-thing-happening-to-me-texas-1126591. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Author of original report

answer to rebuttal

AUTHOR: noneya - ()

SUBMITTED: Friday, March 07, 2014

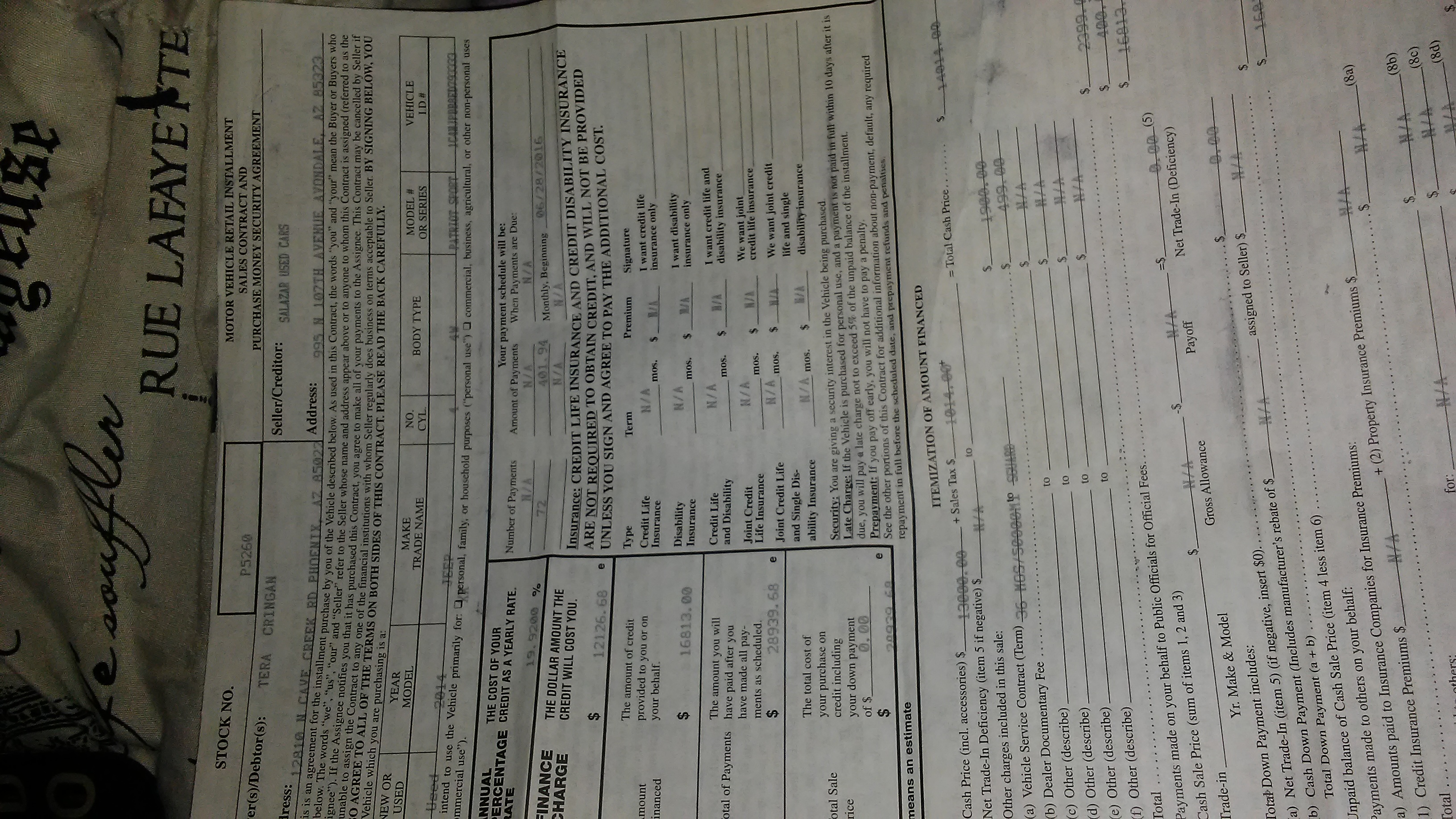

Santander did not tell me my contract started over, the match and years that they say I owe remaining add up to almost exactly my original contract. I made 2 payment in one month, the extra payment not a late payment but paid the next payment ahead and Santender is saying i am late for the the month I paid ahead since I paid oct, nov payment in Oct and then made dec payment in dec they say i was over 30 days late. this has happened a few times so i stopped paying in advance. Santander can not produce my contract and tell me that their attorney does not have a number customers can call and they wont help anyway because my loan was not service orig with them. I have my contract and tons of notes and printouts of payment distro online. I have not tried to cause problems with them because I have read online customers are having their cars repossed after questioning them to much or if they say they will sue them. My loan started April 2007 first payment june 2007. Borrowed 19006.00 at a sick 23 percent for 72 payment. I had a temp 6 month refi when citi still had loan for 8 percent then back to original loan. It was suposed to be a perm refi but not sure what happened. 3 moths after signing santander took over in 2010. There is no way unless i missed so many payments which it would be repoed by now that i still owe almost 14 thousand dollars. I talked to one attorney local and he said it would be a federal case and was afraid to take it. I think it was not fast money, my opinion. I am typing with one hand so excuse all the errors. Thank you for advice it was very sweet of you to take time and respond.

#2 Consumer Comment

Simple Questions

AUTHOR: Jim - ()

SUBMITTED: Wednesday, February 26, 2014

Since you say you have the contract, what does it say? What is the figure for how much the borrowed amount is?

#1 Consumer Comment

You don't have to join a lawsuit against them, you can file your own suit

AUTHOR: FloridaNative - ()

SUBMITTED: Wednesday, February 26, 2014

If you want to sue Santander you can do so on your own without joining a lawsuit that someone else has started against them. It is NOT to your benefit to join another party with a lawsuit because even if you win, you won't get 'made whole' in a class action type suit.

However, based on your post, you have a simple contracts case. If you are the prevailing party, you would be able to be "made whole". All you need is the documents to support your suit and any attorney familiar with these types of suits would be interested. Santander can not force you to pay more than the contracted amount. If you have late payments there would be late fees, but it is difficult to believe that those late fees would add years to your payments.

Gather together your initial contract and proof of all of your payments made from the date of contract through today. Make sure to include the letters from Santander that say you have to 'start over' on your financing when the loan was sold to them. Contact attorney's in your area with your documentation to see how strong a case you have against Santander. This would be an easy case if you have proof of your complaint and proof of payments. If you don't, then it will be difficult. Good luck to you.

Advertisers above have met our

strict standards for business conduct.