Complaint Review: Santander Consumer - Fort Worth Texas

- Santander Consumer PO Box 961245 Fort Worth, Texas USA

- Phone: 888-222-4227

- Web: https:secure.santander.com/formular...

- Category: Auto Dealers

Santander Consumer Citifinancial Predatory Lender, Poor Customer Service, Aggressive Interest and Fees, Long Term Loans with High Rate Fort Worth Texas

*Consumer Comment: Funny...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

SANTANDER CONSUMER

I purchased a vehicle through CarMax financed through Santander Consumer at a high interest rate for a 2009 Kia Rondo for 72 months. My hours were cut on my job and work was slow for my son so we called to make some sort of arrangements with Santander. Their arrangements were to put off payments for 3 months. In the mean while, I became ill with a brain tumor and asked them if they had disability insurance for the account and they said no. The late charges and interest charges were astronomical. Being sick and my son and myself became discouraged having to pay all the added charges. They utimately repossessed the car and sold it for $3,300 and stated that we owed them $11,636.03 for the vehicle in which the most of it is taxes and fees. I don't feel we should have to pay all that money when they have the vehicle and it should not compromise my son's new credit. I became ill and was going through a bad times and made a bad decision dealing with Carmax and Santander. Normally in the past, I would research company's record but I was in a desperate situation, renting a moldy home, transmission went out on my 2010 Chevy Silverado, and I was having health problems thinking about how I would ge back and forth to work. I was trying to maintain an income to continue to work and move to a new place and my time was limited on finding a vehicle. In a time of life's stresses, I was caught off guard and got stuck with an evil predatory lender. Initially I started out paying them for the first 2 years of the loan. Furthermore, I would think that it is fair for them to charge me for the attorney fees of $297.60 and vehicle retaking fee of $600.00, but the access cost of $10,738.43 is ridiculously outrageous and predatory. I feel they should be prosecuted for their unfair lending practices. Also, I would like for my son new credit not to be effected by this Evil practicing company.

This report was posted on Ripoff Report on 12/13/2015 11:03 AM and is a permanent record located here: https://www.ripoffreport.com/reports/santander-consumer/fort-worth-texas-76161-1245/santander-consumer-citifinancial-predatory-lender-poor-customer-service-aggressive-inte-1273935. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Funny...

AUTHOR: Robert - (USA)

SUBMITTED: Sunday, December 13, 2015

It is quite hillarious how when you needed a car and they were the only lender who was willing to take a chance on you they weren't evil. It was only after YOU failed to honor the legally binding contract you signed that they became "evil" and "preditory". This "evil" company even gave you a second chance to keep the car by allowing you to defer 3 payments. But that still wan't good enough for you.

You of course come up with things like "I would normally research a company". Nice try but you see these people are a "Sub-Prime" lender who deal with "high risk" people who have not proven they can handle credit. It is not like you had a line of finance companies wanting to finance you...No matter how much you want to try and convince others, or even yourself. it was these people or nothing.

You also talk about what your feelings. Such as you "feel" that you shouldn't have to pay that much on a car you no longer have. Or that you "felt" discouraged because they added the late fees. Again, sorry but contracts don't work that way, and it is "feelings" like that as to why you most likely had to go with them, and will be with companies like this for many years to come.

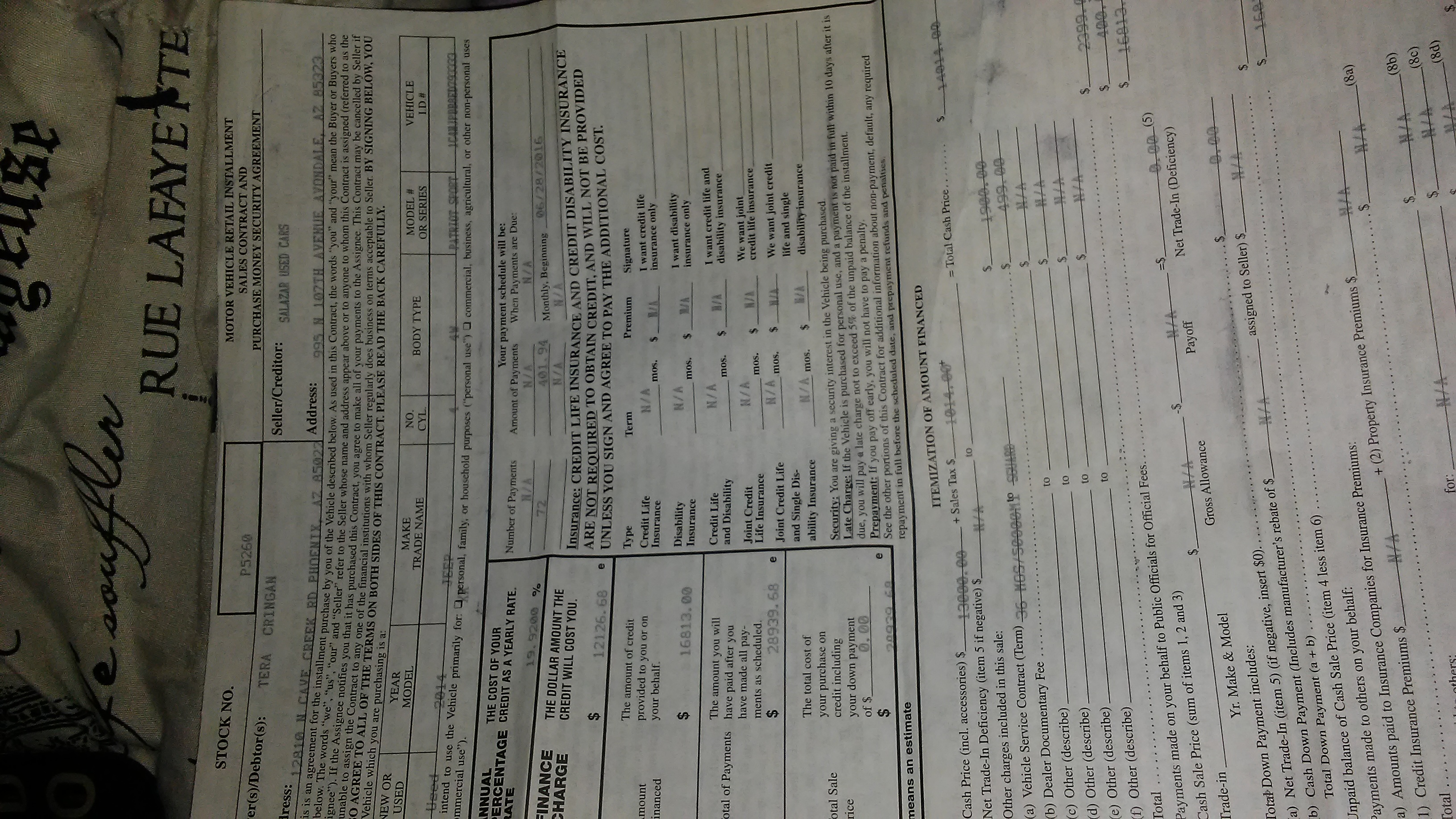

You complain about the amount you owe, but you fully admit you knew what the Interest rate was on the orignal loan. It is also very funny how you say you think that owing over 10K is too much. Okay, so how about giving us the details. How much was the original loan for? What was the Interest Rate, What was the monthly Payment? How long was the loan for?

Yes, this is all important because I can just about figure that you had in addition to a high interest loan, a long term loan(probably 5+ years). Where in these loans for the first couple of years very little(compared to the payment) goes to the actual Principal. So you may only paid down the balance by a couple thousand dollars, but once you become late and they added additional fees and interest the entire amount you paid down was erased.

In a way you are lucky that this is only a civil matter. Because you talk about prosecuting them, but so far the only one who has been in violation of the contract is you. However, since it is a civil matter they may end up suing you. Where if that happens perhaps you can get a judge to help you work something out for the debt you legally owe.

As for your son...If he was on the loan then thanks to your "feelings" about being discouraged you have given your son the same credit you have and he now also gets to enjoy the "sub-prime" life for several years to come.

Oh and no I do not work for them, and would have said just about the same thing regardless of what company name you put.

Advertisers above have met our

strict standards for business conduct.