Complaint Review: Payday-loan-yes - Internet

- Payday-loan-yes payday-loan-yes.com Internet U.S.A.

- Phone: 800-654-7444 x846

- Web:

- Category: Miscellaneous Companies

Pay-day-loan-yes, Payday-loan-yes Payday-loan-yes tried to cheat me out my $$$$money Richmond Internet

*Consumer Comment: from consummeraffairs.com "West Virginia Sues Online Payday Lenders"

*Consumer Comment: Capital News Service

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

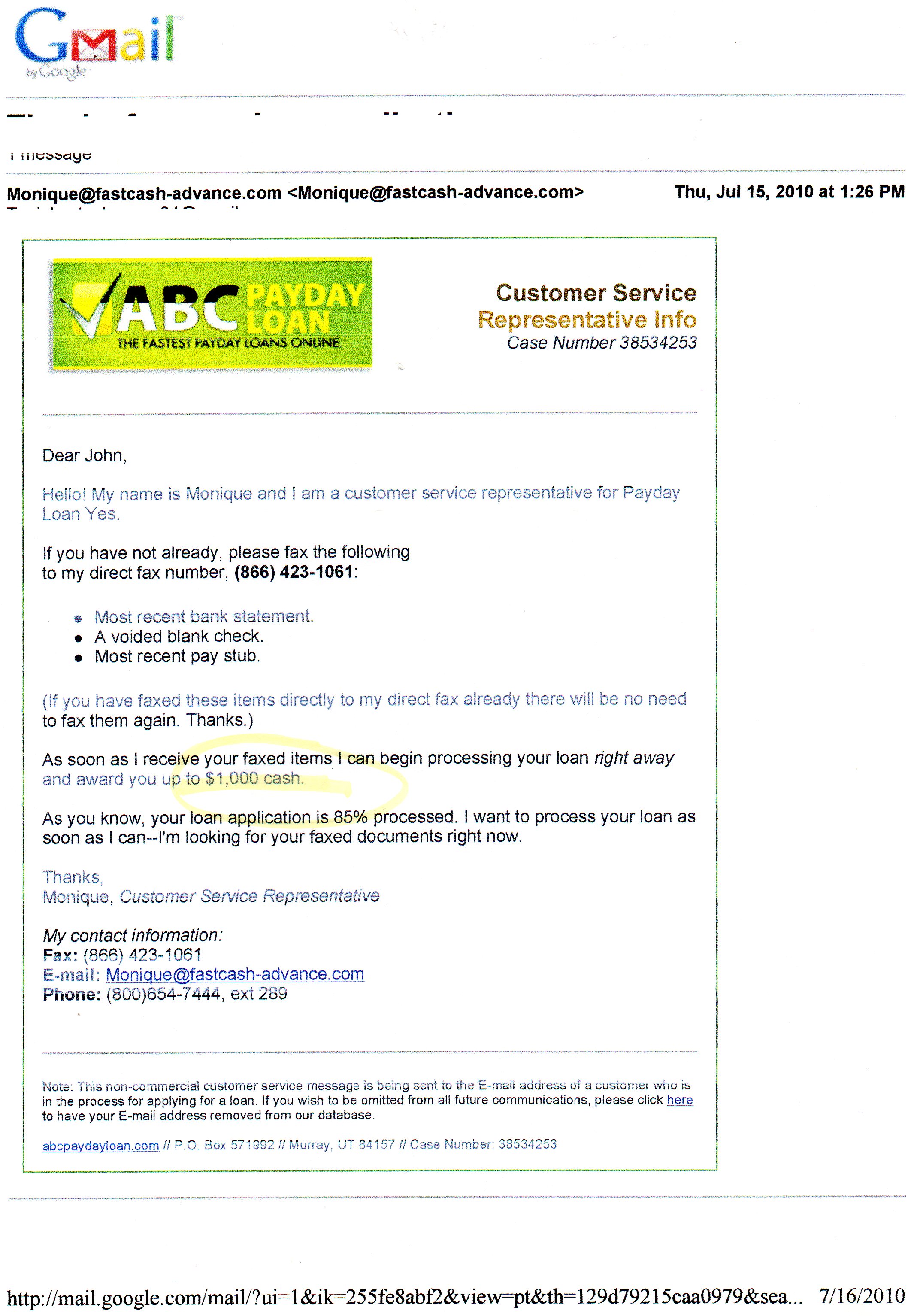

I never had a problem or met a group of people that represent a company like this. Recently in the serach for a short term solution to a money problem I was having. Payday-loan-yes e-mailed me about being eligiable for a pay-day loan. So I responded asking about rates and if they were going to be able to lend me the amount of money I wanted. I was told they would need my paystub info to b4 they could tell me. So i faxed all the information in.

The same got an email telling me I was approved for $350.00 and the rate would be like $105.00 every time I renewed it. I looked at that stuff and almost fell out. I never faxed backed the signed application like it said to do because the rate was way to high. And I would leave it as a last resort if needed. So three days later when I check my email I see I had a deposit 2 days ago. I signed on to my bank account to find out that they had deposited the money without my signed paperwork.

I imediatly got on the phone and started sending out emails.(Unfortunatly nobody was there it was christmas weekend) So when I finally got in thouch with someone she told me to contact customer service and they would take the money back. I was relived because I didnt want to have to get into it with anybody. So when I contacted customer service they told me "oh no thats not going to happen" and suggested that I just pay the amount back and the finance charge. I told her that she could debit the $350.00 right back out because it hasnt been thouched. She started yelling and getting an attitude. The conversation ended with her hanging up on me.

The next day I saw a debit in the amount of $105.00(the finance charge) I called again and got not suitable answer to how a loan is processed without a signature. So I cancelled my checking account and had my bank cancell that transaction to get their attention. And it worked they emailed me talking about problems with my checking avvount and I told them I knew about it and asked how THEIR MISTAKE was going to be fixed. All I got back was a settlement offer for $590.00. I told them it was going to happen and I am more then willing to buy one of those prepaid visa cards and put the money on or send them a check. I am not going to give them any of my checking info again.

I was also told that this company is not licensed to do business in Virginia and through my resaerch are not following the rule and regulations of payday loan companies. I contacted the comessionors affice and they advised me to send everything to them and they would try to help reslove the problem. It seems as though this was nothing new. These companies do this all the time. Please if you want and need a payday loan go to one of the locations because as far as virginia is concerned no internet payday loan lenders are licensed to do business in va.

Nathasa

Richmond, Virginia

U.S.A.

This report was posted on Ripoff Report on 01/09/2009 07:16 AM and is a permanent record located here: https://www.ripoffreport.com/reports/payday-loan-yes/internet/pay-day-loan-yes-payday-loan-yes-payday-loan-yes-tried-to-cheat-me-out-my-money-richm-409957. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

from consummeraffairs.com "West Virginia Sues Online Payday Lenders"

AUTHOR: Laurie - (U.S.A.)

SUBMITTED: Tuesday, March 31, 2009

March 30, 2009

West Virginia Attorney General Darrell McGraw has filed two lawsuits against 12 Internet payday lenders and their collection agencies, with the aim of preventing them from doing business in the state.

Both suits ask the court to order compliance with McGraw's investigative subpoenas and to enjoin the companies from the continued making or collection of payday loans in West Virginia.

Payday loans, which have never been legal in West Virginia, are short-term loans or cash advances, typically for 14 days, secured by a post-dated check or, when offered over the Internet, secured by an agreement authorizing an electronic debit for the full loan amount plus interest from the consumer's account.

Internet payday loans are electronically deposited into consumers' accounts and typically require payment of interest with annual percentage rates ("APR") ranging from 600 to 800 APR, more than 45 times greater than the maximum allowable rate 18 percent APR for such loans in West Virginia.

"Internet payday loan providers are the loan sharks of today," said McGraw.McGraw says Internet payday loans are the industry's most recent attempt to skirt consumer protection laws. He complains that the payday lending industry has historically sought to evade state usury laws through a number of ruses, such as partnering with national and state-chartered banks and by offering the loans over the Internet.

McGraw's office began its investigation of the Internet payday lending industry in earnest in 2005. As of this date McGraw's office has successfully concluded 75 investigations of Internet payday lenders and their collection agencies, which have netted a total of $1,784,772.82 in cash refunds and cancelled debts for 6,612 West Virginia consumers.

The payday lenders named in the latest filings include the following:

(((Redacted)))

Collection agencies named in the suits are:

A.C.A Recovery, Inc. of Ridgewood, NJ

Capital Collections, LLC of Miami, FL

Covenant Management Group, LLC of Gainesville, GA

Oasis Financial Solutions, LLC of Orange Park, FL

Westbury Ventures of Wilmington, DE

CLICK here to see why Rip-off Report, as a matter of policy, deleted either a phone number, link or e-mail address from this Report.

#1 Consumer Comment

Capital News Service

AUTHOR: Josie - (U.S.A.)

SUBMITTED: Monday, March 30, 2009

Hello. I am a reporter for the Capital News Service of Virginia Commonwealth University and have been assigned a two-part article series on a serious topic.

Another reporter and I have chosen to write about payday lenders and the risks by having a personal anecdote from someone who has become a victim included in our story.

With that, I was just writing to see if maybe you were interested in speaking with one of us on your experience so that we can correctly inform other Virginians of the risks of the payday lenders by providing another citizen's account.

Our article, if picked up by any papers, would be that of local Virginia.

If you would like to contact me about setting up an interview, my e-mail address is (((Redacted)))

Thank you,

Josephine Varnier

CLICK here to see why Rip-off Report, as a matter of policy, deleted either a phone number, link or e-mail address from this Report.

Advertisers above have met our

strict standards for business conduct.