Complaint Review: Santander Consumer - Fort Worth Texas

- Santander Consumer PO Box 961245 Fort Worth , Texas USA

- Phone: (888) 222-4227

- Web: Santanderconsumerusa.com

- Category: Financial Services

Santander Consumer AKA Santander, Santander Consumer, Santander Consumers, Santander Bank Santander abuses their consumers! Fort Worth Texas

*Consumer Comment: What a RipOff

*Author of original report: ...

*Consumer Comment: A few things for you..

*Author of original report: Do not judge what you don't understand.

*Consumer Comment: Ha, Ha, Ha! Thanks For The Laughs!!!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I have started 2 petitions to help everyone wronged by Santander Consumers. I am trying to gather everyone (which there are tens of thousands!) who have been wronged by this company and it's bulldozer tactics. I'm contacting their attorneys as well as news stations, please help by uniting us all and signing these petitions to bring justice for every hard working person being taken advantage of by their unethical acts!

This report was posted on Ripoff Report on 06/25/2013 06:36 PM and is a permanent record located here: https://www.ripoffreport.com/reports/santander-consumer/fort-worth-texas-75266/santander-consumer-aka-santander-santander-consumer-santander-consumers-santander-bank-1062104. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Consumer Comment

What a RipOff

AUTHOR: Robert - ()

SUBMITTED: Sunday, June 30, 2013

..and I mean this report. Seriously if you actually look at your claims you would realize that.

You talk about ignorance and not understanding..but your entire "RipOff" is based on ignorance and not understanding.

Just for the fact that you admit you don't know much about loans. So perhaps they aren't the way you really "think". You say that you haven't had issues like this with your other loans..how do you know? Is the situation EXACTLY the same? Then you admit that you pr your sister have never been "harrassed" for being one day late that this was only an "assumption" on your part.

You claim 10's of thousands of people are being ripped off..but again 2 signatures on your petitions and 6 lawsuits. By the way can you please post where you found these 6 lawsuits...it might be interesting reading for any interested party.

Then of course we have your claim that your sister has never been late beyond the "grace period"(which I have already explained how that is a wrong claim). So is this just another "assumption" of yours? Have you proven this? Have you asked to look at every one of her statments and/or cancelled checks to see if she is telling the truth? Have you done the amortization tables to see if the loan is being applied correctly? Do you even know what an amortization table is?

As I mentioned before if you have proof then go ahead and sue them. But you said that because of their "fine print" it would be in effect worthless to do. Well could that be because this "fine print" you talk about is what you and your sister agreed to when you signed it with the original bank?

#4 Author of original report

...

AUTHOR: Jennifer - ()

SUBMITTED: Saturday, June 29, 2013

The petitions were my way of allowing other people to express their discontent with the company, something I felt was right.

The 6 lawsuits I was referring to we're solely harassment cases, as I was trying to stay on topic and I do not know the companies' legal history.

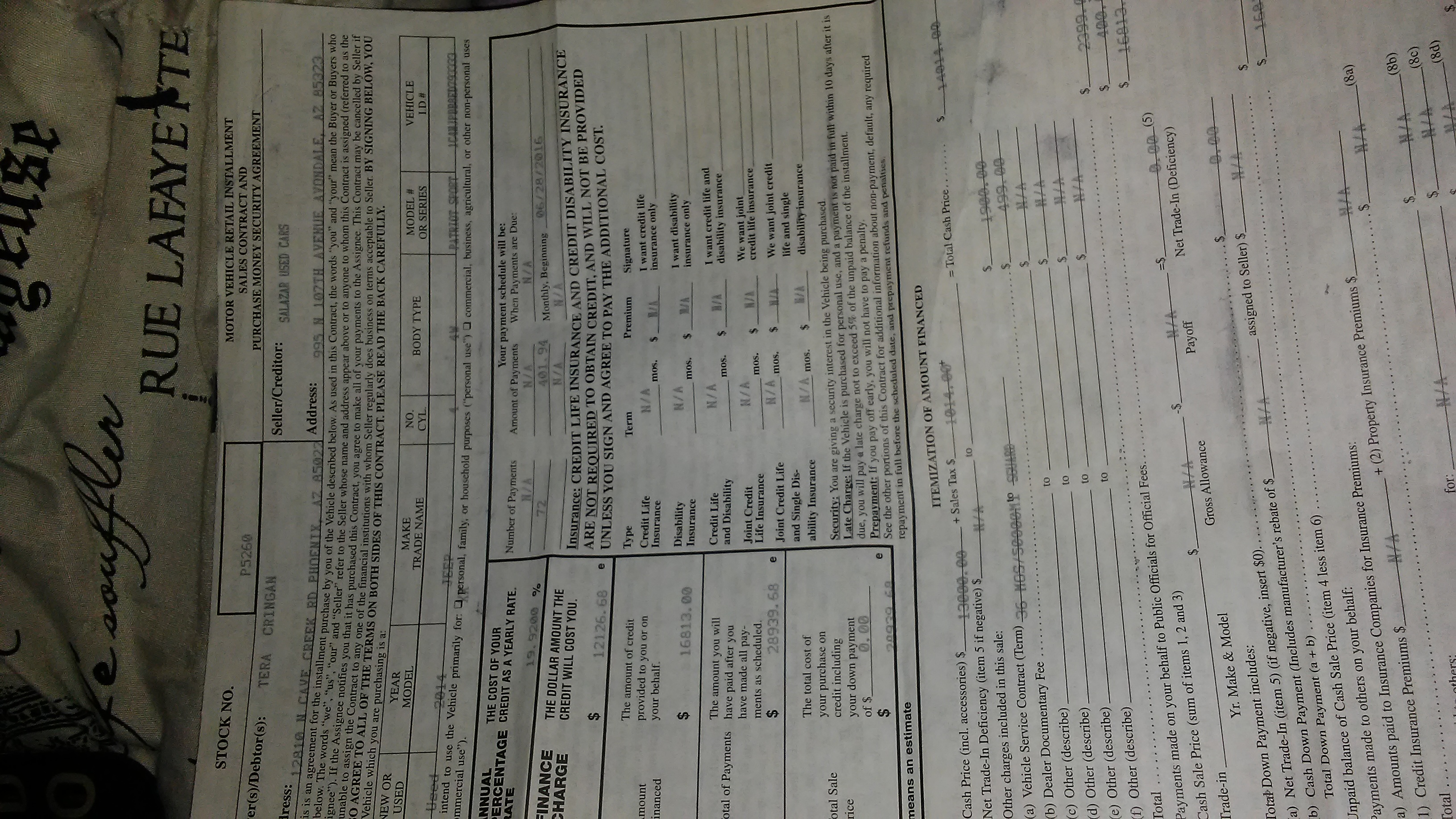

I do not know much about loans, but I like to think I am a pretty ethical and moral person and I do know the way this company is conducting business is not ethical. My husband and I have had two 5 year auto loans within the last 7 years, both with different banks and have been paid off with none of these issues.

I wrote it was very difficult to obtain legal advise because the company was continuously terminated my calls, ignoring paperwork requests, and not allowing us to record phone calls to prove misrepresentation. The 1 day late statement was not a personal experience, it was an assumption that they harassed you for being late based upon the 6 lawsuits won for harassment.

I have not contacted a lawyer yet, seeing as with all the small print, and lawyers Santander is armed with due to the way they conduct business, it is going to be a s**t show. I'm waiting for the attorney general and Santander's general councel to respond back to me, considering I'm not one of those people looking to sue the pants off of them and get a free car because my credit was crap and my feelings were hurt.

#3 Consumer Comment

A few things for you..

AUTHOR: Robert - ()

SUBMITTED: Friday, June 28, 2013

First of all your petitions are really a joke and a good laugh...after all 2 down and only 99,998 signatures to go in the next just a little over 3 weeks.

Next..there is no such thing as a "Grace Period". Her payment is due on a specific date, if it is not made by that date it is LATE. Now, there is a period they give you before an ADDITIONAL Late Fee is assessed, but that does not change the fact that if payment is not made by the due date she is late.

You say that Stantander bought the loan. Well first of all EVERY loan or finance agreement you will ever sign will always have a clause that says the company can sell/transfer your loan at any time and without your approval. If your bank didn't get bought out, what most likely happened is that your bank sold off some of it's "riskier" loans, as that is pretty much Standard Operating Procedure. So even though you don't like it..you and your sister are still legally responsible for the loan even though you didn't specifically sign a contract with Stantander.

Any complaints about the high interest or fees need to be taken up with your bank because when you got the loan with that bank..that is what you agreed to. While I doubt that they have changed the Interest Rate, and this is just a case that you don't have any idea how loans work. If you have actual PROOF that they have changed the terms, then find a lawyer and sue them. If you have this proof you should have no shortage of lawyers who are more than willing to take your case on contingency so that they can get the publicity to go after the "big evil company". But keep in mind that "fees" such as payment fees are often excluded as that is a service fee and not directly related to the loan.

By the way if your claim is that 10's of thousands of people have been wronged..please explain how you could only find 6 that is SIX lawsuits. Let's see 10's of thousands vs. 6..ummm.

One other statement from your original report that makes no sense. How does them calling you for being 1 day late make it "very difficult" to seek legal advise? Wouldn't that make it easier for a lawyer to "catch" them in this case?

#2 Author of original report

Do not judge what you don't understand.

AUTHOR: Jennifer - ()

SUBMITTED: Wednesday, June 26, 2013

First of all, I would like to apologize to anyone who was forced to read your butchering of the English language and poor use of grammar. Second off, the late payment harassment call statement was based off of the 6 lawsuits that have been filed and won againest Santander Consumer in the last 16 months. My sister who is primary on the account has never missed or been late beyond the given "grace period" on a payment. I am the cosigner, because of my credit and income due to her young age and lack of credit. We did not originally sign a loan with Santander Consumer, the bank sold our loan to them, unannounced. So before "wailing" in your computer chair, take a look at yourself and question why you're trolling complaint sites and judging others without knowing their situations. The fees and interest rates we're being charged are NOT in the original contract we signed with the bank we filed the loan with. In fact there isn't a contract with Santander Consumer, because I would never deal with a company with the reputation that they carry. I'm assuming with your attitude and ignorance you so boldly carry, you work for this company because you never went to college and a call center job is as good as it gets for you. Have fun meeting your sale quotas and good luck in your future endeavours!

#1 Consumer Comment

Ha, Ha, Ha! Thanks For The Laughs!!!

AUTHOR: Jim - ()

SUBMITTED: Wednesday, June 26, 2013

First off, Santander is NOT a bank...its a SUBPRIME finance company! Secondly all of your blustering about interest being paid up-front is exceedingly hilarious because that's how loans work! So again, thanks for the laughs! In the final analysis, it doesn't even matte because if you have a 48 month loan, in 48 months it will be paid with both interest and principle. Therefore, how the payments are applied doesn't make one difference! If your wailing about interest rates, then why are you even dealing with them? Why? Because YOU destroyed YOUR OWN credit and YOU do not qualify for a low interest rate bank loan! Finally, since your also wailing about them calling you, why are they calling you in the first place? Why? Because you are NOT paying on time! This is exactly what happened to your previous creditors...you screwed them over as well! Anyway, thanks for the laughs!

Advertisers above have met our

strict standards for business conduct.